In Our View

Convertible Arbitrage Market Dynamics

A conversation between

Global Head of Convertible Arbitrage

Global Co-Head Client Partner Group

Michael Gubenko: Following the end of the zero-interest-rate policy (ZIRP), several factors pointed to a potential rebound in convertible bond issuance. How did these dynamics unfold over the past year, and what is your outlook heading into next year?

Stephane Mantelin: As was the case in 2024, we and many other market participants began 2025 highly optimistic about the outlook for primary convertible bond issuance. Elevated interest rates have provided a clear tailwind, as the lower coupons on convertible debt provide corporates with an attractive alternative to traditional straight debt financing. As a result, much of the recent issuance has been driven by refinancing activity, particularly as companies address the looming “maturity wall” of debt issued during the pandemic.

As we look ahead to 2026, there are several reasons to remain constructive on the outlook for convertible bonds. In addition to higher rates, the potential for elevated single-name realized volatility, partly explained by a backdrop of lingering policy and trade uncertainty, incentivizes investors to pay up for the embedded equity option. This dynamic helps issuers raise capital at more attractive terms, whether through lower coupons or higher premiums.

Second, a potential reacceleration of M&A activity could provide another meaningful tailwind, with issuers turning to convertibles as a lower-cost way to finance corporate activity.

Finally, we continue to see a rebound in issuance out of Asia. While the latest deals brought to market have featured aggressive terms, we expect this issuance trend to continue and hope for greater discipline from investors in the future, as we closely monitor for more compelling opportunities.

Michael Gubenko: Artificial intelligence (“AI”) has been one of the most talked-about trends and a major driver of economic activity. From your vantage point, what impact has AI had on the convertible bond market?

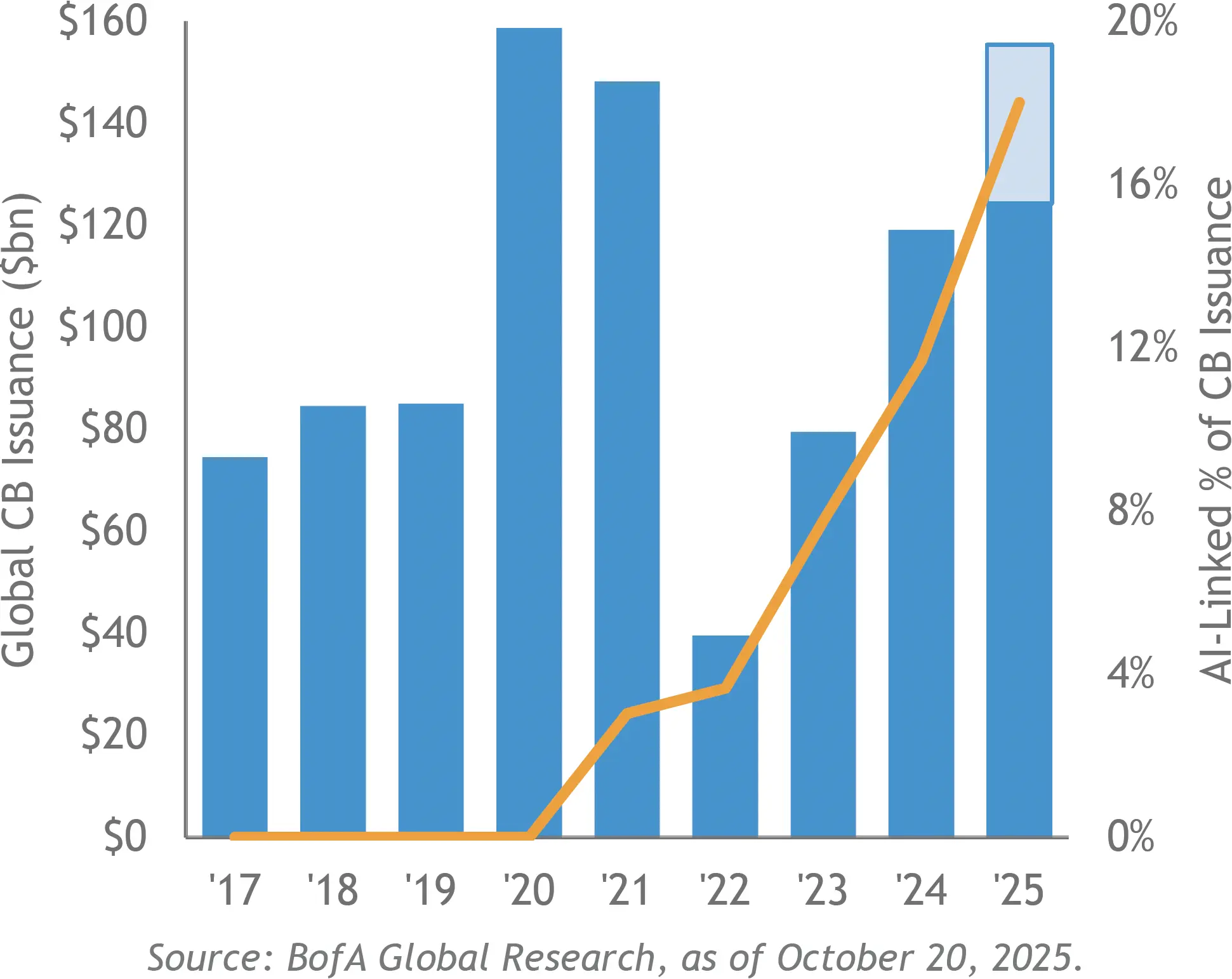

Stephane Mantelin: The most visible impact has been a surge in issuance, driven by massive capex across a broad range of sectors—from building advanced data centers and upgrading cloud infrastructure to expanding energy generation capacity. Given the convertible bond market has long served as a key financing channel for growth and technology companies, this sudden wave of AI-linked issuance is not unexpected. In fact, it is estimated that roughly one-fifth of all new global convertible bond issuance in 2025 is tied to the AI ecosystem.1

For us, this dynamic has been a welcome addition and an expanding source of opportunity as many of these issuers offer attractive convexity and volatility profiles. As with any secular trend of this magnitude, there will inevitably be both winners and losers. To that end, this dispersion plays well to our long volatility strategy. have the added benefit of working closely with our fundamental equities specialists who have long studied AI-related businesses to identify where volatility may be mispriced or where there is an event-driven catalyst that we want to be positioned around, as well as with our credit specialists, who provide diligence on underlying credit assumptions.

Global CB & AI-Linked Issuance

Michael Gubenko: Crypto has been another hot area in markets — has this been a source of opportunity as well?

Stephane Mantelin: Ever since the crypto market began to establish itself as an institutional asset class, our approach has remained market-neutral — we have deliberately avoided taking directional views, choosing instead to participate through arbitrage opportunities.

Over the past twelve months, crypto-linked issuance has surged in the convertible bond market. Beyond crypto miners and related infrastructure firms, we’ve also seen the emergence of crypto treasury reserve strategies. We remain cautious toward these companies due to limited conviction around their creditworthiness in stress scenarios. Financing and hedging costs could also be volatile in these situations, driven by the crowding in both the equity and convertible bond markets of these issuers.

That said, there are areas within the crypto theme that we believe offer a more attractive risk–reward profile for our style of nondirectional arbitrage. One such area of opportunity has been in crypto miners that have repositioned themselves as high-performance computing (HPC) providers, capitalizing on the surge in demand for AI-driven computational capacity. This strategic pivot from crypto to AI infrastructure offers a more dependable growth trajectory: rather than mining cryptocurrencies opportunistically when prices exceed marginal power costs, these firms can now monetize stable power capacity through long-term contracts for AI workloads. Consistent with this example, our broader approach to the asset class has been to focus on companies and spread trades where returns are independent of the price of Bitcoin and other digital assets.

Michael Gubenko: Convertible bond arbitrage has been back in the spotlight recently. Given that you and the convertible arbitrage team have worked together in this domain for several decades, what would you say to an investor who thinks of convertible bond arbitrage as a cyclical investment strategy?

Stephane Mantelin: For all the reasons mentioned, it’s been an attractive environment for convertible arbitrageurs. However, we know from experience that running the strategy successfully across market cycles requires significant discipline. Credit has been performing well, which has provided a tailwind for investors who maintain lighter credit hedges than we do. For our strategy, with spreads near their tightest levels, we view this as an opportunity to establish hedges at more favorable levels. We believe this conservative approach, coupled with a stable capital base that can withstand periods of heightened volatility, sets us apart from more transient participants who enter and exit the space episodically.

Michael Gubenko: Although short-lived, how did the April volatility across equity and credit markets affect the opportunity set in convertible bond markets?

Stephane Mantelin: From a positioning standpoint, we entered the period of turbulence with a relatively defensive posture. In the months leading up to it, we had reduced exposure given elevated overall market valuations.

Although the initial shock down was nearly as swift as the subsequent recovery, convertible bond valuations came under pressure alongside other asset classes. We focused on adding exposure to higher quality names offering attractive convexity, while generating returns by effectively capturing gamma.

Following this period of stress, we observed a strong rebound in issuance, likely driven by issuers seeking to opportunistically raise capital through issuance of equity-linked instruments as stocks rallied back toward their highs.

Michael Gubenko: You emphasized the importance of deep credit work, especially as companies faced upcoming debt maturities. How does this shape your overall investment strategy?

Stephane Mantelin: The credit component plays a critical role in how we construct trades and evaluate hedge effectiveness. Because it is often the most challenging aspect to hedge, we dedicate a disproportionate amount of time to underwriting the credit of a convertible bond, which serves as a key differentiator in our style of arbitrage investing.

While we strive to minimize negative outcomes, when faced with challenges we can leverage Sculptor’s large team of dedicated opportunistic credit professionals. This integrated approach has been critical in turning adverse scenarios into profitable outcomes.

Michael Gubenko: What do you consider critical for success in your investment approach?

Stephane Mantelin: Throughout its 30-year history, Sculptor convertible arbitrage has remained committed to staying as close as possible to the purest form of market-neutral, non-directional arbitrage. We have avoided style drift and momentum trading—pitfalls that have negatively impacted many other convertible funds and portfolios across different market cycles.

Our strategy is also supported by a sophisticated counterparty and liquidity risk management framework, which is central to the investment process. Using proprietary technology and detailed analytics, we closely track counterparty exposure, financing arrangements, and liquidity. This expertise informs daily investment decisions in the convertible arbitrage strategy and becomes especially critical during periods of market stress.

Important Disclosures & Appendix

Important Information

This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund or account managed by Sculptor Capital Management, Inc. or Sculptor Capital LP and its affiliates (collectively, “Sculptor Capital Management,” the “Firm,” “Sculptor,” or the “Company”), nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any produce, offering or investment. Any offer to purchase or buy securities or other financial instruments will only be made pursuant to an offering document and a subscription document, which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with any such offering. Any investment decision should be based on the information contained in the private placement memorandum. This material does not create any advisory relationship; such a relationship may only be established through a formal advisory contract.

The statements made herein reflect the subjective views and opinions of Sculptor. Such statements cannot be independently verified and are subject to change. There can be no assurance that the investment discussed herein will ultimately be successful or are representative of all investments made in a particular Sculptor strategy or product. The information contained herein may not be reproduced or used in whole or in part for any purpose, and there can be no assurance any investment strategy will perform as discussed herein or that any historical trends will persist in the future. The source of all information contained herein is Sculptor, unless otherwise noted. Past strategy and investment allocations are not necessarily indicative of future strategy or investment allocations.

While private investment funds offer investors the potential for attractive returns and diversification, they pose greater risks than more traditional investments. Investors’ capital is at risk and investors may lose all or a substantial portion of their investment. Investors should consider the risks inherent with investing in private investment funds, which include, but are not limited to, leveraged and speculative investments, limited liquidity, higher fees and expenses and complex tax structures. The tax treatment of any investment will depend on the individual circumstances of each investor and may be subject to change in the future. Sculptor has in place policies and procedures designed to prevent market abuse and insider dealing. These policies and procedures are reviewed on a regular basis.

Some of the information contained herein has been obtained from third party sources. Sculptor has relied on the accuracy of such information and has not independently verified its accuracy. Sculptor makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain economic and market conditions contained herein have been obtained from published sources and/or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete. Past performance is not a reliable indicator of future results. A more detailed description of Sculptor’s investment strategy, objectives and related risk will be made available upon request. Past performance of any individual investment or Sculptor fund is not indicative of their future performance.

The information contained in this document is presented to inform decisions to use Sculptor Capital LP as an investment adviser.

1. BofaA Global Research, as of October 20, 2025.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this document constitutes “forward-looking statements” that can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any Sculptor Capital investment may differ materially from those reflected or contemplated in such forward-looking statements.

Risk Factors

The following considerations, which summarize some, but not all, of the risks of investing in the strategy should be carefully evaluated before making an investment in the strategy. The information set forth under “Risk Factors” in the strategy’s Confidential Memorandum must be reviewed in its entirety prior to investing in the strategy. An investment in the strategy will involve significant risks, including the loss of the entire investment. The interests in the strategy will be illiquid, as there is no secondary market for interests in the strategy and none is expected to develop.

Dependence on Sculptor. The success of the strategy is dependent upon the ability of Sculptor to manage the strategy and effectively implement the strategy’s investment program. Sculptor’s governing documents do not permit the limited partners to participate in the management and affairs of Sculptor or the strategy. If Sculptor, the strategy or any other funds managed by Sculptor were to incur substantial losses in the case of other funds, or were subject to an unusually high level of redemptions or withdrawals, the revenues of Sculptor may decline substantially. Such losses and/or redemptions/withdrawals may impair Sculptor’s ability to provide the necessary level of service to Sculptor and the strategy as it has in the past and continue operations. The loss of the services of Sculptor could have a material adverse effect on Sculptor and the limited partners’ investments therein.

Liquidity of Investments. The strategy invests in securities which are subject to legal or other restrictions on transfer or for which no liquid market exists. The market prices, if any, for such securities tend to be volatile and the strategy may not be able to sell them when it desires to do so or to realize what it perceives to be their fair value in the event of a sale. The sale of restricted and illiquid securities often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than does the sale of securities eligible for trading on national securities exchanges or in the OTC markets. Restricted securities may sell at a price lower than similar securities that are not subject to restrictions on resale.

Risks of Equity Investment Strategies. Some of the strategies may result in high portfolio turnover and, consequently, greater transaction costs. Depending upon the investment strategies employed and market conditions, the strategy may be adversely affected by unforeseen events involving such matters as changes in interest rates or the credit status of an issuer, forced redemptions of securities or acquisition proposals, break-up of planned mergers, unexpected changes in relative value, short squeezes, inability to short stock or changes in tax treatment. There can be no assurance that Sculptor will be able to locate investment opportunities or exploit pricing discrepancies.

General Credit Risk. The issuers of debt instruments may face significant ongoing uncertainties and exposure to adverse conditions that may undermine the issuer’s ability to make timely payment of interest and principal. In addition, major economic downturns and financial market swings have adversely affected, and could in the future adversely affect, the ability of some of the issuers of such instruments to repay principal and pay interest thereon and may increase the incidence of default for such instruments.

Risks Associated with the strategy’s Distressed Investment Sub-Strategies. The success of the strategy’s investment activities will depend to an extent on Sculptor’s ability to identify and benefit from inefficiencies in the high-yield and distressed debt securities markets. These opportunities involve uncertainty. No assurance can be given that Sculptor will be able to locate investment opportunities or to correctly take advantage of inefficiencies in the markets. A reduction in inefficiencies that provide opportunities, for example, for covenant arbitrage or capital structure arbitrage will reduce the scope for the strategy’s investment strategies. In the event that the perceived mispricings underlying the strategy’s positions were to fail to converge toward, or were to diverge further from, relationships expected by Sculptor, the strategy may incur a loss. Further, the investments utilized in implementing such strategies will include derivatives, such as futures and options, which are themselves inherently volatile in the context of specific market movements.

Distressed Investment Risk. The strategy may invest, directly or indirectly, in securities of U.S. and non-U.S. issuers in weak financial condition, experiencing poor operating results, having substantial capital needs or negative net worth, facing special competitive or product obsolescence problems, or that are involved in bankruptcy or reorganization proceedings. Investments of this type may involve substantial financial and business risks that can result in substantial, or at times even total, losses. Among the risks inherent in investments in troubled entities is the fact that it frequently may be difficult to obtain information as to the true condition of such issuers. Such investments also may be adversely affected by laws relating to, among other things, fraudulent transfers and other voidable transfers or payments, lender liability and the bankruptcy court’s power to disallow, reduce, subordinate or disenfranchise particular claims.

Derivative Instruments. Certain swaps, options and other derivative instruments may be subject to various types of risks, including market risk, liquidity risk, credit risk, legal risk and operations risk. The regulatory and tax environment for derivative instruments in which the strategy may participate is evolving, and changes in the regulation or taxation of such instruments may have a material adverse effect on the strategy. General Economic and Market Conditions. The success of the strategy’s activities will be affected by general economic and market conditions, such as interest rates, availability of credit, credit defaults, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation of the strategy’s investments), trade barriers, currency exchange controls, and national and international political circumstances (including wars, terrorist acts or security operations). These factors may affect the level and volatility of the prices and the liquidity of the strategy’s investments. Volatility or illiquidity could impair the strategy’s profitability or result in losses. The strategy may maintain substantial trading positions that can be adversely affected by the level of volatility in the financial markets.

Non-U.S. Securities. Investments in securities of non-U.S. issuers (including non-U.S. governments) and securities denominated or whose prices are quoted in non-U.S. currencies pose, to the extent not hedged, currency exchange risks (including blockage, devaluation and non-exchangeability) as well as a range of other potential risks which could include, expropriation, confiscatory taxation, imposition of withholding or other taxes on dividends, interest, capital gains, other income or gross sale or disposition proceeds, limitations on the removal of funds or other assets of the strategy, political or social instability or diplomatic developments that could affect investments in those countries.

Investment and Due Diligence Process. Before making investments, Sculptor will conduct due diligence based on the facts and circumstances applicable to each investment. When conducting due diligence, Sculptor may be required to evaluate important and complex business, financial, tax, accounting and legal issues. When conducting due diligence and making an assessment regarding an investment, Sculptor will rely on the resources reasonably available to it, which in some circumstances, whether or not known to Sculptor at the time, may not be sufficient, accurate, complete or reliable. Due diligence may not reveal or highlight matters that could have a material adverse effect on the value of an investment.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE RESULTS. INVESTMENTS ARE SUBJECT TO A RISK OF LOSS AND INVESTORS MAY LOSE ALL OR A SUBSTANTIAL PORTION OF THEIR INVESTMENT.