What We See

Unlocking Value Across the Vast Universe of Asset Based Finance

November 2025

Overview

Asset Based Finance (ABF) is now one of the most exciting segments within private credit, drawing increased attention from both investment firms and capital allocators. While the strategy’s growth potential is widely recognized with many new entrants joining the space, few market participants possess the flexibility and discipline required to unlock its full value. The solution: dynamic and adaptive investing.

This approach to investing leverages broad capabilities and disciplined capital deployment, resulting in the ability to continuously capitalize on persistent sources of excess spread across the enormity of ABF markets. Long-term shifts in wholesale funding that began after the Global Financial Crisis, now accelerated by near-term catalysts and new market entrants, have created a particularly compelling window of opportunity. In this evolving landscape, where capital is abundant and economic outcomes are increasingly uncertain, such dynamism is essential to achieving superior risk-adjusted returns.

Dynamic Investing in Asset Based Finance

Dynamic credit investing in ABF relies on two core principles: maintaining a broad investment toolkit across the ABF universe and exercising discipline in continuously deploying capital to the most attractive risk-adjusted returns. This flexible mandate across sectors, sizes, and structures enables investors to consistently uncover and exploit inefficiencies that traditional lenders and narrowly focused credit managers often overlook.

Several enduring structural features of ABF markets make them especially well-suited for a dynamic approach, particularly for investors with deep credit expertise and the capacity to navigate complexity. These include:

- A vast and structurally complex market: ABF spans a wide range of asset types and structures, including Residential, Commercial, Consumer, and Specialty sectors, creating a market that is difficult to categorize and often inaccessible to conventional credit capital. We estimate this market exceeds $12 trillion in size.

- Lack of standardization: The bespoke nature of ABF, combined with limited transparency and inconsistent reporting, legal frameworks, and asset definitions, makes risk assessment highly nuanced. These challenges are especially pronounced outside the U.S., where jurisdictional complexity further fragments the market.

- Persistent reputational overhang: Despite improved fundamentals and underwriting standards since the 2008 financial crisis, parts of the ABF market remain tainted by legacy perceptions. This has discouraged many institutional investors, leaving significant portions of the market underappreciated and underserved.

Together, these factors create a structurally inefficient financing environment. As banks and other traditional capital providers continue to retreat from large segments of the real asset space due to regulatory pressure and past market shocks, the opportunity for skilled, non-bank lenders to step in has grown increasingly attractive.

Recent Trends Have Created Increased Inefficiencies

In recent years, record amounts of capital have been raised to pursue opportunities in ABF, much of it within narrowly focused, sector-specific vehicles. As a result, flexibility and a go-anywhere investment mandate have become more important than ever—not only for uncovering overlooked or underappreciated sectors, but also for actively avoiding overcrowded areas of the market.

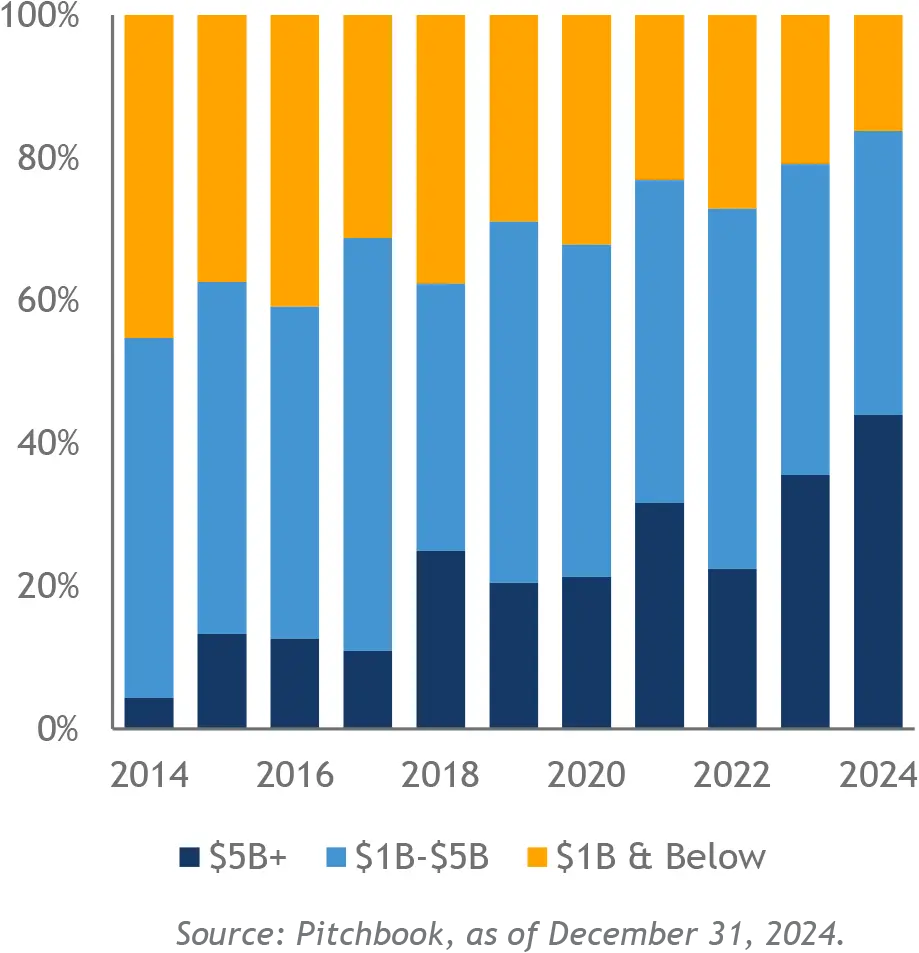

While there is a perception that size is essential to accessing the most attractive opportunities, the data suggests otherwise. Nearly 85% of private debt capital raised last year went into funds with more than $1 billion in AUM, creating intense pressure to deploy capital into a limited number of “mega-transactions.” This has led to diseconomies of scale, where an abundance of capital drives down returns rather than enhancing them.

Private Debt Capital Raised by Fund Size

A recent example is the competitive bidding process for a nearly $1 billion auto loan portfolio, which attracted significant attention due to its size. Despite the operational complexity including thousands of underlying borrowers and the need for sophisticated infrastructure, the portfolio ultimately priced at tight levels, less attractive than smaller, comparable portfolios. Similar dynamics have emerged in recent multi-billion-dollar French and U.S. mortgage pool sales, as well as large unsecured consumer credit forward flow agreements, where scale did not translate to better pricing or value.

In this environment, the ability to remain agile—targeting more nuanced, less-contested opportunities—is a clear advantage in delivering superior risk-adjusted returns.

Seizing the Opportunity with Flexibility

Dynamic investing is at the heart of Sculptor’s approach to ABF. Since 2007, this philosophy has underpinned nearly $50 billion of investments across the ABF universe, including Residential, Commercial, Consumer, and Specialty assets. Our adaptive nature enables us to evaluate opportunities across the full market spectrum, free from the artificial limitations that restrict many sector-specific strategies.

This flexibility allows us to focus solely on sourcing transactions that offer compelling excess spread, without being pressured to “fill buckets.” By staying nimble and selective, we consistently identify niche, complex, or underappreciated opportunities that lie outside the reach of traditional or narrowly focused lenders. Many of these transactions are either too small, too intricate, or too unconventional for larger market participants to pursue effectively.

Unlike firms with captive origination platforms who may be compelled to absorb volume regardless of quality, we retain full discretion over our investment decisions, including when and where we allocate capital. This ensures strong alignment between origination and investment objectives, avoids conflicts of interest, and allows us to remain focused solely on the most compelling risk-adjusted returns. The result is a flexible and dynamic deployment model that adapts to shifting market conditions, asset types, acquisition strategies, and structures.

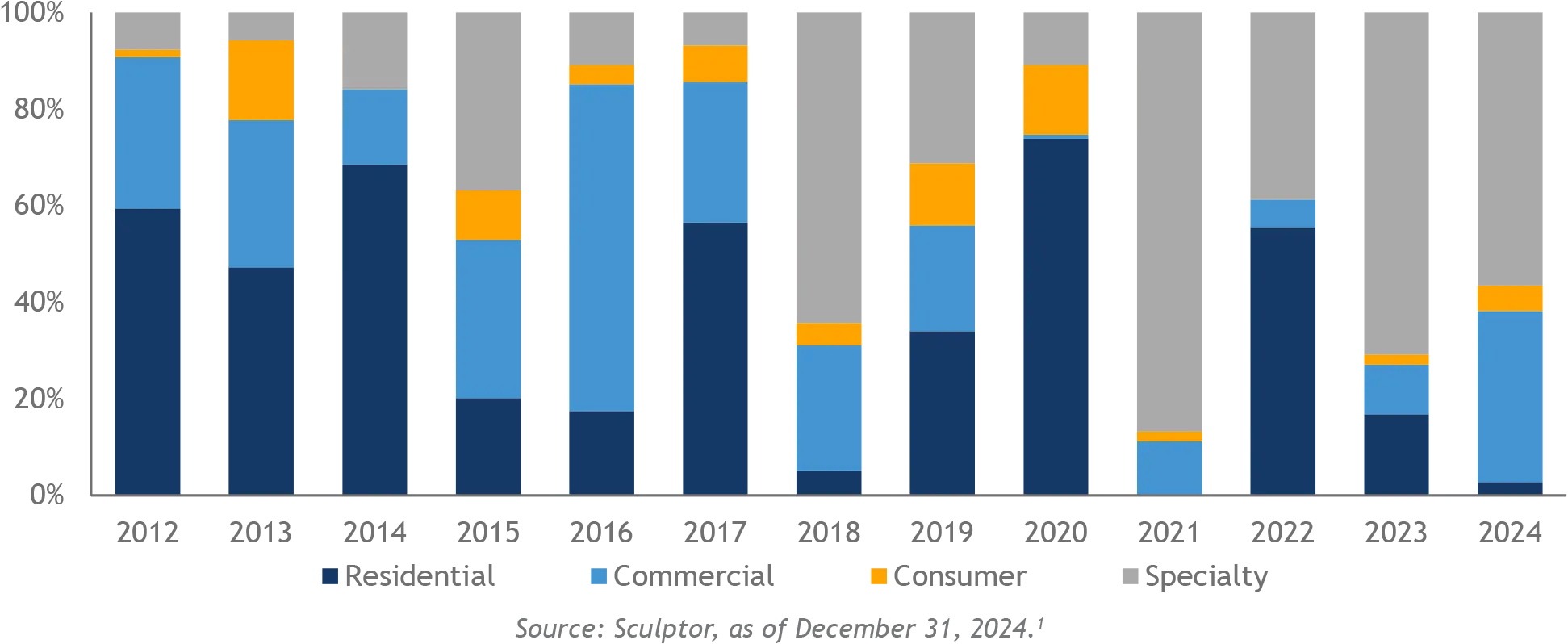

Historical Capital Deployment by Asset Type

A Track Record of Flexibility in Action1

Our investment history in the chart above clearly demonstrates that we are not anchored to any single asset type, rather, we go where the opportunity is most attractive. The 2020–2022 period provides a vivid example of this philosophy in practice:

- 2020: As the COVID-19 pandemic disrupted global markets, we rapidly pivoted into Residential mortgages—driven by conviction in a housing recovery, strong borrower fundamentals, and historically wide spreads. While others hesitated, we acted early and decisively. Residential assets accounted for nearly 75% of our capital deployed that year, up from just roughly 35% in 2019.

- 2021: As spreads tightened and Residential valuations surged, the opportunity became less compelling. Rather than chase returns dependent on leverage and ultra-low funding, we shifted toward bespoke and structurally complex investments, especially in Specialty Finance. Activity in Residential dropped to near zero, while Specialty Finance rose from roughly 10% to nearly 90% of our deal volume. Investments included secured hard asset finance, SRT transactions, and dislocated aviation-related assets—where returns were driven by structural features, not spread compression.

- 2022: With interest rates spiking and securitization markets stalling, we returned to Residential—but in a very different form. We financed portfolios of stranded mortgage assets, acquiring deeply out-of-the-money deals with strong downside protection. Though reliant on the same underwriting discipline, these transactions required significantly different structuring approaches to unlock value. This evolution was not an anomaly: it exemplifies our consistent approach to ABF. As market trends shift, we adapt. Across Residential, Consumer, Commercial, and Specialty sectors, our allocation strategy evolves in response to risk-reward conditions, sourcing frameworks, and transaction complexity. We believe our ability to underwrite across sectors, source off-market opportunities, and structure around complexity is central to unlocking long-term value in ABF markets, and remains a core differentiator of our platform.

Narrowbody Aviation2

Aviation financing changed drastically during COVID. Previously a well-capitalized space supported by a deep bench of public securitization market participants, the pandemic drove a sharp pullback that resulted in both equity and debt financing sources abandoning the midlife sector. Geopolitical conflicts and global economic concerns have further added to these challenges. With a robust recovery in global passenger traffic, an undersupplied new aircraft market, and desires for fleet modernization, what once was primarily an ABS driven market is now vastly underserved. Given our extensive activity in aviation over a near twenty year investing history, including serving as the exclusive asset manager for a worldwide leader in aviation financing, we were able to analyze not only the capital shortage in the midlife space, but also the fundamental shortage in aircraft metal confronting airlines. Ongoing production and performance issues related to new aircraft deliveries have supported midlife aircraft valuations, making it our preferred corner of the market. Since the Russian invasion of Ukraine, new issuance of aviation ABS debt has remained dormant while higher benchmark rates and wider spreads have led many aircraft owners to warehouse assets or seek alternative financing. Although ABS spreads began tightening in 2023, overall financing costs remained elevated. This created a window to target high-yield, unlevered opportunities on a selective basis. Capitalizing on these conditions, our activity was elevated in 2024 within the Specialty sector. One transaction that contributed to this broader focus was the acquisition of a midlife Airbus A320 aircraft on lease to a wholly-owned subsidiary of one of the world’s premier airlines. The aircraft had originally been aggregated alongside other aircraft pre-COVID by its owner in anticipation of a public securitization. However, the 2022 rate hiking cycle and broader macro uncertainty further suppressed demand for aviation ABS, stalling the transaction. By late 2023, the seller had failed to reach sufficient scale for a securitization and began to offload individual assets. We saw an opportunity to acquire the aircraft at a historically wide yield relative to comparable aviation assets and broader credit instruments, supported by highly attractive pricing, limited financing options in the market, and, in our view, a fundamental misunderstanding of the credit risk of the lessee. The leaseholder benefits from the financial strength of its parent company, which has ample cash on its balance sheet, limited debt and an implicit credit backing from the government. Despite improving sentiment at the time, many lessors remained constrained by elevated funding costs, allowing us to transact at an attractive yield with upside tied to potential spread tightening along with improvement in lease rates and residual value of the metal.

Key Pillars Enabling Dynamic Investing Within an Expansive Asset Class

In a market characterized by limited transparency and structural fragmentation, analytical depth, sourcing reach, and disciplined execution are essential to executing on this strategy.

- Proprietary Data & Analytics: In ABF, access to meaningful data is often the defining edge. Investors must rely on proprietary performance data, historical analogs, and sophisticated cash flow modeling to assess true relative value. At Sculptor, we have developed purpose-driven technology and analytics infrastructure since 2007 to meet this challenge. Our proprietary platform includes extensive market and asset-level data, much of it is unavailable through third-party providers, enabling precise underwriting with deep contextual insight. This platform also allows for cross-asset comparison across diverse structures, helping us to consistently identify investments with the strongest risk-adjusted returns.

- Consistent and Active Market Presence: Sculptor’s longstanding presence across all ABF verticals has established our reputation as a trusted counterparty. These relationships with both specialist and generalist originators grant us consistent access to complex, time-sensitive, and off-market opportunities. Importantly, our approach is to remain actively engaged in sourcing and underwriting even during quieter deployment periods. This ensures pricing and structuring discipline is maintained while preserving market access, rather than stepping away and risking disconnection. As market conditions shift, this continuous presence enables agile capital reallocation to the most compelling risk-reward opportunities.

- Disciplined Investment Framework: Every investment at Sculptor is evaluated within a defined and multi-layered risk management process. Opportunities undergo detailed analysis by the investment team, rigorous vetting by the investment committee, and independent validation by our risk and analytics groups. This framework ensures that capital is only deployed into situations we deeply understand, and only when the risk-reward profile is clearly favorable.

Conclusion

ABF sits at the intersection of long-term structural inefficiencies and near-term market changes. The post-GFC regulatory environment, shifting bank priorities, and a rising rate backdrop have created a fertile environment for private capital. In this evolving landscape, dynamic investing provides a distinct edge, enabling unconstrained allocation into the most attractive risk-adjusted opportunities. As capital continues to pour into the space, the ability to stay nimble, independent, and disciplined is proving more essential than ever.

Important Disclosures & Appendix

Important Information

This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund or account managed by Sculptor Capital Management, Inc. or Sculptor Capital LP and its affiliates (collectively, “Sculptor Capital Management,” the “Firm,” or “Sculptor”), nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any produce, offering or investment. Any offer to purchase or buy securities or other financial instruments will only be made pursuant to an offering document and a subscription document, which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with any such offering. Any investment decision should be based on the information contained in the private placement memorandum. This material does not create any advisory relationship; such a relationship may only be established through a formal advisory contract.

The statements made herein reflect the subjective views and opinions of Sculptor. Such statements cannot be independently verified and are subject to change. There can be no assurance that the investment discussed herein will ultimately be successful or are representative of all investments made in a particular Sculptor strategy or product. The information contained herein may not be reproduced or used in whole or in part for any purpose, and there can be no assurance any investment strategy will perform as discussed herein or that any historical trends will persist in the future. The source of all information contained herein is Sculptor, unless otherwise noted.

Certain figures and calculations contained herein were internally generated by Sculptor based on estimated data and analysis. These figures and calculations have not been audited or otherwise confirmed by a third party. Additional important Regulatory Disclosures regarding region-specific regulatory requirements (e.g., the European Union’s Sustainable Finance Disclosure Regulation (“SFDR”)) are available here: https://www.sculptor.com/terms-of-use.

While private investment funds offer investors the potential for attractive returns and diversification, they pose greater risks than more traditional investments. Investors’ capital is at risk and investors may lose all or a substantial portion of their investment. Investors should consider the risks inherent with investing in private investment funds, which include, but are not limited to, leveraged and speculative investments, limited liquidity, higher fees and expenses and complex tax structures. The tax treatment of any investment will depend on the individual circumstances of each investor and may be subject to change in the future.

Some of the information contained herein has been obtained from third party sources. Sculptor has relied on the accuracy of such information and has not independently verified its accuracy. Sculptor makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain economic and market conditions contained herein has been obtained from publishes sources and/or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete. A more detailed description of the Sculptor’s investment strategy, objectives and related risk will be made available upon request.

- Past strategy allocations and exposures are not necessarily indicative of future allocations and exposures.

- The investment example contained herein (the “Case Study”) is being provided for information purposes only and is not intended to be and should not be considered a recommendation to purchase or sell any security or to invest in any fund managed by Sculptor. The Case Study was selected by Sculptor using non-performance based criteria as a representative example of the investment themes discussed herein, and specifically, an example of a recent investment that Sculptor considers to be outside of the traditional scope of narrowly focused asset based finance managers. The Case Study is not presented (and was not selected) on the basis of performance. There can be no assurance that any Case Study or any actual account would realize its investment objectives or be profitable. Furthermore, there can be no assurance that any future investments will be realized at a profit, and any investment could lose all or a substantial portion of its value. The Case Study is not the only investment example that meets the aforementioned selection criteria.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this herein constitutes “forward-looking statements” that can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any Firm investment may differ materially from those reflected or contemplated in such forward looking statements.

Risk Factors

The following considerations, which summarize some, but not all, of the risks of investing in any particular strategy managed by Sculptor should be carefully evaluated before making an investment. An investment in the strategies described herein involve significant risks, including the loss of the entire investment. The information contained in the governing documents of any particular investment vehicle (including, without limitation, any risk factors contained therein) must be reviewed in its entirety prior to making any such investment.

General Economic and Market Conditions. The success of the strategy’s activities will be affected by general economic and market conditions, such as interest rates, availability of credit, credit defaults, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation of the strategy’s investments), trade barriers, currency exchange controls, and national and international political circumstances (including wars, terrorist acts or security operations). These factors may affect the level and volatility of the prices and the liquidity of the strategy’s investments. Volatility or illiquidity could impair the strategy’s profitability or result in losses. The strategy may maintain substantial trading positions that can be adversely affected by the level of volatility in the financial markets. A downturn in the relevant financial markets may occur at any time, which could result in a deterioration in the financial condition of various parties.

Investment and Due Diligence Process. Before making investments, Sculptor will conduct due diligence based on the facts and circumstances applicable to each investment. When conducting due diligence, Sculptor may be required to evaluate important and complex business, financial, tax, accounting and legal issues. When conducting due diligence and making an assessment regarding an investment, Sculptor will rely on the resources reasonably available to it, which in some circumstances, whether or not known to Sculptor at the time, may not be sufficient, accurate, complete or reliable. Due diligence may not reveal or highlight matters that could have a material adverse effect on the value of an investment.

General Credit Risk. The issuers of debt instruments may face significant ongoing uncertainties and exposure to adverse conditions that may undermine the issuer’s ability to make timely payment of interest and principal. In addition, major economic downturns and financial market swings have adversely affected, and could in the future adversely affect, the ability of some of the issuers of such instruments to repay principal and pay interest thereon and may increase the incidence of default for such instruments.

Leverage and Financing Risk. It is expected that some or all of the strategy will leverage their capital. Accordingly, the strategy may pledge their securities and may provide other forms of security or assurance in order to borrow additional funds for investment purposes. The strategy also may leverage its investment returns with derivative instruments. The amount of borrowings which the strategy may have outstanding at any time may be large in relation to their capital. Leverage has the effect of potentially increasing losses. Accordingly, any event which adversely affects the value of an investment by a strategy would be magnified to the extent the strategy is leveraged. The cumulative effect of the use of leverage by a strategy in a market that moves adversely to the strategy’s investments could result in a substantial loss to the strategy.

Non-U.S. Securities. Investments in securities of non-U.S. issuers (including non-U.S. governments) and securities denominated or whose prices are quoted in non-U.S. currencies pose, to the extent not hedged, currency exchange risks (including blockage, devaluation and non-exchangeability) as well as a range of other potential risks which could include expropriation, confiscatory taxation, imposition of withholding or other taxes on dividends, interest, capital gains, other income or gross sale or disposition proceeds, limitations on the removal of funds or other assets of the strategy, political or social instability or diplomatic developments that could affect investments in those countries.

Liquidity of Investments. The strategy may acquire securities that are traded only among a limited number of investors. The limited number of investors for those securities may make it difficult for the strategy to dispose of those securities quickly or in adverse market conditions. Some markets in which the strategy may invest may prove at times to be insufficiently liquid or illiquid. The strategy may invest in securities which are subject to legal or other restrictions on transfer or for which no liquid market exists. The market prices, if any, for such securities tend to be volatile and the strategy may not be able to sell them when they desire to do so or to realize what they perceive to be the fair value of the securities in the event of a sale. Furthermore, there is a risk that, because of a lack of liquidity and efficiency in certain markets due to unusual market conditions or unusually high volumes of repurchase requests or other reasons, the strategy may experience some difficulties in purchasing or selling holdings of securities and, therefore, meeting subscriptions and withdrawals in a timely manner.

Distressed Investment Risk. The strategy may invest, directly or indirectly, in securities of U.S. and non-U.S. issuers in weak financial condition, experiencing poor operating results, having substantial capital needs or negative net worth, facing special competitive or product obsolescence problems, or that are involved in bankruptcy or reorganization proceedings. Investments of this type may involve substantial financial and business risks that can result in substantial, or at times even total, losses. Among the risks inherent in investments in troubled entities is the fact that it frequently may be difficult to obtain information as to the true condition of such issuers. Such investments also may be adversely affected by laws relating to, among other things, fraudulent transfers and other voidable transfers or payments, lender liability and the bankruptcy court’s power to disallow, reduce, subordinate or disenfranchise particular claims.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE RESULTS. INVESTMENTS ARE SUBJECT TO A RISK OF LOSS AND INVESTORS MAY LOSE ALL OR A SUBSTANTIAL PORTION OF THEIR INVESTMENT.