Q & A: Merger Arbitrage

A Conversation Between:

Jeff Lin

Jeff Lin is the Global Head of Equities and oversees public equity investments globally within Sculptor’s Fundamental Equities and Merger Arbitrage strategies. Within both Fundamental Equities and Merger Arbitrage, he works closely with investment professionals across geographies and asset classes to maximize the Firm’s research capabilities in the investment process. Mr. Lin has over 19 years of investment experience, specializing in arbitrage and event-driven investing.

Michael Gubenko

Michael Gubenko is Global Head of Portfolio Specialist Group and is primarily responsible for partnering with the Firm’s clients to deliver investment insights on Sculptor’s investment businesses. In addition, he oversees certain strategic relationships of the Firm and partners with those clients to provide investment solutions that meet their needs.

Michael Gubenko: A few years ago, Merger Arbitrage was a large allocation in the multi-strategy fund, but today that allocation is much smaller. Why is that?

Jeff Lin: There are unusual dynamics at play today that are contributing to what appears to be a wide spread environment. That said, there’s a bifurcation in deals where of the approximately $350bn in pending deal market cap in transactions, 50% are trading at less than 50% implied probability, two-thirds of deals are at less than 75% probability, and the majority of the remainder are at 95% plus. This is a reflection of the regulatory uncertainty which is probably as high as it has ever been. This uncertainty leads to the concern that there will be a lawsuit in every deal and the larger the buyer, the higher the probability of the FTC or DOJ suing.

Additionally, in our experience this results in longer deal timelines which necessitates larger spreads to account for the time value of money in a higher rate environment. The longer timeline also introduces risks associated with changing fundamentals against a volatile macroeconomic backdrop.

Given these dynamics, this presents more risk in deals, which means we have to size our positions smaller and more actively trade them to manage risk, generally buying dislocations and selling in normalizations.

Michael Gubenko: Why does this backdrop not line up well with your approach to merger arbitrage?

Jeff Lin: Historically we have always favored deal complexity, but in situations that can be underwritten on a fundamental basis. That could take the form of hostile transactions, cross border deals, or more general mispriced spreads. While the current market is giving us opportunity in several wide deal spreads related to antitrust risk where we have a view on the target, the safe “rate-of-return” deals are trading effectively at the risk-free rate. We suspect that dedicated arb funds or pools of capital have misaligned incentives to allocate to those spreads. In the riskier deals with heightened regulatory risk, arbitrageurs are now betting on court outcomes, which is not the kind of risk we like to take.

“There are undoubtedly still opportunities that we like, particularly in deals where we believe there is conviction on the underlying fundamental value of the target”

Jeff Lin

Global Head of Equities

Michael Gubenko: Given your current modest allocation to merger arbitrage, where have you focused your current exposure?

Jeff Lin: There are undoubtedly still opportunities that we like, particularly in deals where we believe there is conviction on the underlying fundamental value of the target. In these cases, we think that the current uncertainty also plays to our strength of having both merger arb and fundamental investment expertise. In one recent example, we started deeply researching an interactive entertainment software company six to nine months after a deal was announced. At the time, we could tell the street was focused on the deal spread and no one was focused on the improving fundamentals. We thought it was a great opportunity and found differentiated sources of primary research and data, allowing us to have a view on the two if its new product releases. Over time people have started to recognize its value – last fall the consensus downside stock price was approximately $55 by the street, now it’s $75. That’s a big move and changed the implied probability.

In general, though, it’s not a market today to invest in a fully diversified portfolio of deals because spreads are wide for a reason and safe deals trade tight. One needs to be selective and be very opportunistic. We expect more complications in deals including lawsuits, but those situations create opportunity.

Michael Gubenko: Conversely, what have you sought to avoid?

Jeff Lin: Generally, we don’t like to invest in risky deals where we don’t have a strong fundamental view. We like situations where we feel that we are differentiated on both the target and the acquirer. This means that if a deal was to break, we would be comfortable at implied deal break prices owning the positions from a fundamental perspective. Unlike many generalists who just take the index mark to market as downside underwriting, we heavily research the downside on everything we own in concert with our fundamental equity industry experts to develop a proprietary downside view.

Moreover, in this environment where there is an abundance of capital chasing safe deals at incredibly tight spreads, we also avoid those as they don’t meet our return thresholds.

Michael Gubenko: You mentioned the collaborative process in underwriting positions, how is that structured?

Jeff Lin: We’re very collaborative across our platform given many colleagues across the firm touch single name investments in some way. Particularly amongst our fundamental equities strategy team we have an embedded arbitrage culture – every merger arb position will have two analysts on it covering both the deal and as I mentioned earlier, also formulating a fundamental thesis. If there are concerns about the credit or financing, we’ll work closely with our credit colleagues. We believe that is one of the core strategic advantages of our investment model.

Michael Gubenko: From a strategy perspective, how does merger arbitrage fit in the context of the broader portfolio?

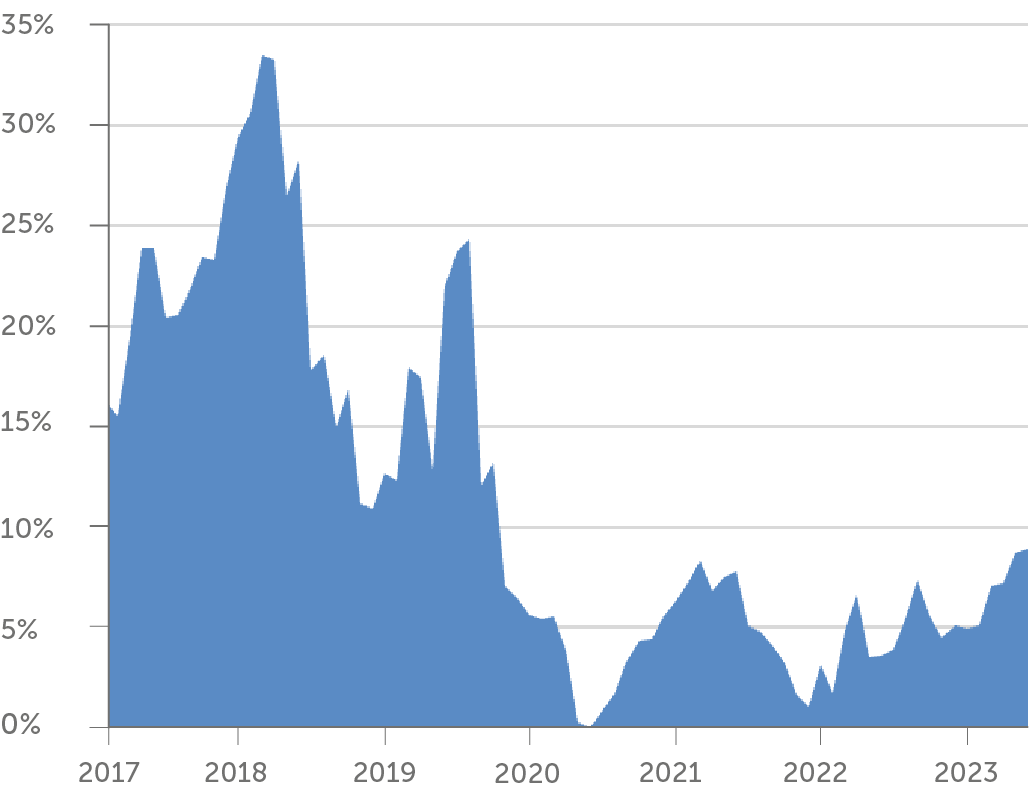

Jeff Lin: We pride ourselves on being fully opportunistic. We could be 0% of the multi-strategy fund or we’ve been as large as nearly 35%, but ultimately it depends on what we see as the best risk reward opportunities across asset classes. While, in our opinion, the current market environment doesn’t afford enough opportunities that we like to make a larger allocation, should the conditions change we know we have the ability to deploy significant capital in a moment’s notice.

Merger Arbtitrage Exposure1

1 Source: Sculptor. As of June 30, 2023. Past strategy allocations and exposures are not necessarily indicative of future allocations and exposures. Strategy allocations and exposures are measured on the first day of each month during the period.

Important Information

This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund (“Fund”) managed by Sculptor Capital Management, Inc. or Sculptor Capital LP and its affiliates (collectively, “Sculptor Capital Management,” the “Firm,” “Sculptor,” or the “Company”). This material does not constitute investment advice and does not create any advisory relationship; such a relationship may only be established through a formal advisory contract. The statements made herein reflect the subjective views and opinions of Sculptor. Such statements cannot be independently verified and are subject to change. There can be no assurance any investments discussed herein will ultimately be successful or are representative of all investments made in a particular Sculptor strategy or product. The information contained herein should be treated in a confidential manner and may not be reproduced or used in whole or in part for any purpose, nor may it be disclosed, without prior written consent of Sculptor. The source of all information contained herein is Sculptor, unless otherwise noted. Past strategy and investment allocations are not necessary indicative of future strategy or investment allocations.

While private investment funds offer investors the potential for attractive returns and diversification, they pose greater risks than more traditional investments. Investors’ capital is at risk and investors may lose all or a substantial portion of their investment. Investors should consider the risks inherent with investing in private investment funds, which include, but are not limited to, leveraged and speculative investments, limited liquidity, higher fees and expenses and complex tax structures. The tax treatment of any investment will depend on the individual circumstances of each investor and may be subject to change in the future. Sculptor has in place policies and procedures designed to prevent market abuse and insider dealing. These policies and procedures are reviewed on a regular basis.

Some of the information contained herein has been obtained from third party sources. Sculptor has relied on the accuracy of such information and has not independently verified its accuracy. Sculptor makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain economic and market conditions contained herein has been obtained from publishes sources and/or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete. Past performance is not a reliable indicator of future results. A more detailed description of the Sculptor’s investment strategy, objectives and related risk will be made available upon request. Past performance of any individual investment or Sculptor fund is not indicative of their future performance.

The information contained in this document is presented to inform decisions to use Sculptor Capital LP as an investment adviser, should be treated as confidential, and may not be shared with others absent the written consent of Sculptor Capital LP. By accessing this information, you expressly agree to keep such information confidential and to refrain from purchasing or selling Sculptor Capital Management Inc. stock based on such information or advising others to do the same.